Charlie Ball's regular summary of data and reports from the labour market, brought to you by Prospects Luminate and Jisc Data Analytics

The latest round of the Office for National Statistics (ONS) fast response experimental statistics on the impact of COVID were released on the 4th June.

- 8% of the UK workforce were furloughed - this is approximately 3.4 million people.

- 29% of the workforce worked solely from home last week.

- The volume of UK online job adverts on 28 May 2021 was at 127% of its February 2020 average level, up eight percentage points from the previous week. This was driven by increases in the number of job adverts across all UK countries and English regions when compared with the previous week.

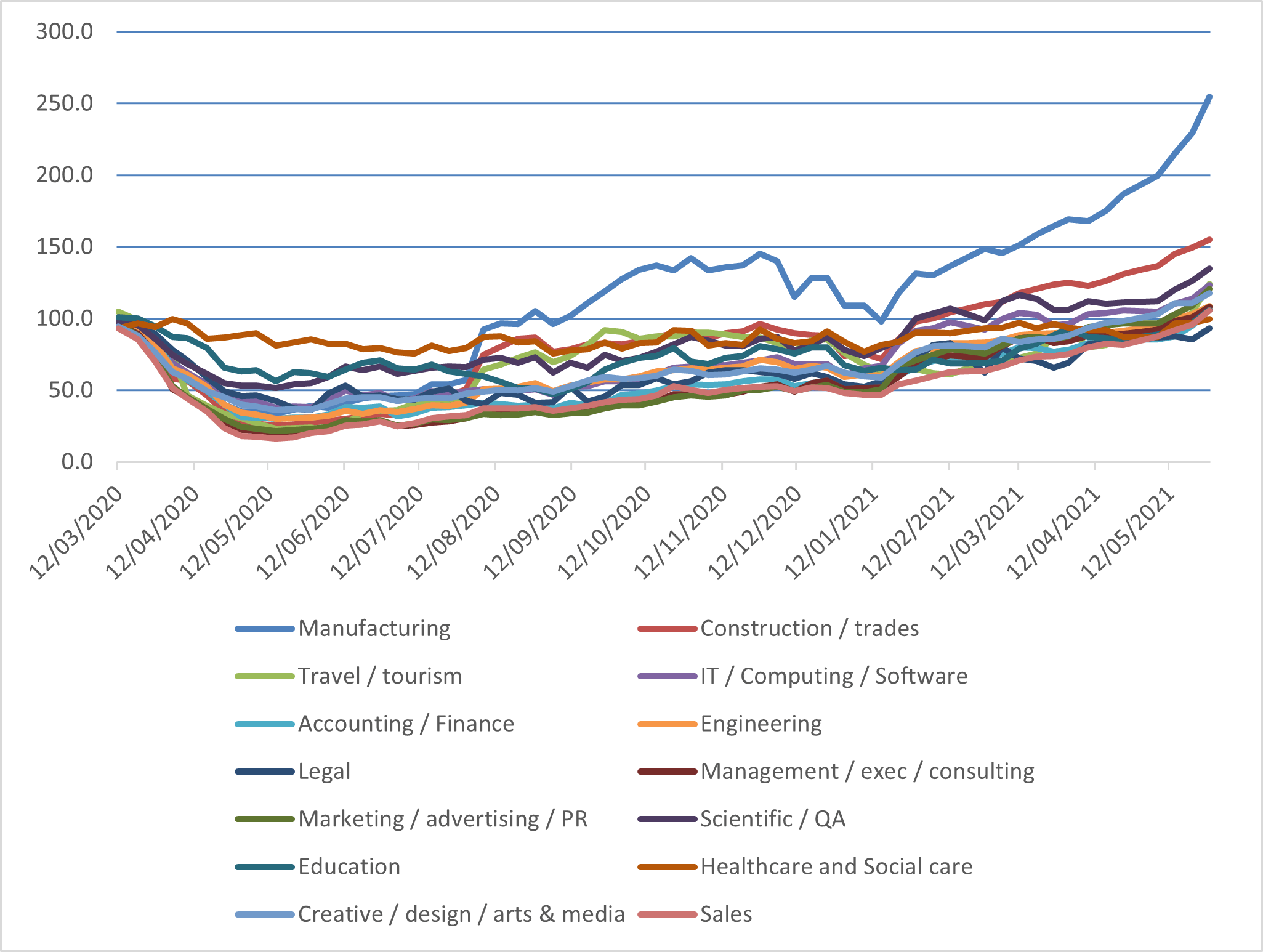

Below is a chart of how vacancies on Adzuna have changed since February 2020 - the level of ads in each category is compared to the February 2020 level, which is set as 100.

The ONS have also released some new data on personal and economic wellbeing:

- Those groups that were financially impacted at the start of the COVID-19 pandemic were still worse off up to mid-April 2021, such as the self-employed, who were three times as likely to report reduced income and twice as likely to use savings to cover living costs compared with employees.

- Those in the lowest income bracket (up to £10,000 per annum) continued to be more likely to report negative impacts to personal wellbeing in comparison with higher brackets, such as the coronavirus pandemic making their mental health worse (18%) and feeling stressed or anxious (32%).

- Those in the highest income brackets (£40,000 a year or more) continued to be more likely to report that the coronavirus pandemic was negatively impacting their working life, and were six times as likely to report the pandemic was having a strain on their working relationships; those employed were over twice as likely to find working from home difficult than those in the lowest income bracket.

- Employed parents were less likely to be furloughed since the beginning of 2021, unlike in the first phase of lockdown, but were still more likely to report reduced income than non-parents. Despite the financial impacts, all parents continued to feel less lonely and report higher scores of feeling that things done in life are worthwhile.

- Those aged under 30 years were consistently more likely to report that their income had been reduced (15%) than those over 60 years (5%). However, a higher proportion of those under 30 years reported being able to save for the year ahead (50%) than older age groups (39%).

- Perceptions of incomes and savings also appeared to differ; for example, those in the youngest age group were less financially resilient than older age groups, with 47% of those under 30 years reporting that they could afford an unexpected expense compared with 71% of those over 60 years, despite a higher proportion reporting that they were able to save for the year ahead.

The Organisation for Economic Cooperation and Development (OECD) have issued new forecasts for the UK economy:

- Strong GDP growth of 7.2% in 2021 and 5.5% in 2022 is projected as a large share of the population is vaccinated and restrictions to economic activity are progressively eased.

- Growth is driven by a rebound of consumption, notably of services. GDP is expected to return to its pre-pandemic level in early 2022.

- However, increased border costs following the exit from the EU Single Market will continue to weigh on foreign trade.

- Unemployment is expected to peak at the end of 2021 as the Coronavirus Job Retention Scheme is withdrawn.

- Inflation is set to increase due to past increases in commodity prices and strong GDP growth.

- Supply bottlenecks could hold back consumption and increase inflation beyond what is projected if businesses fail to reopen or cannot attract the necessary staff after the pandemic due to net out-migration.

- Public investment should address long-term challenges, notably reducing greenhouse gas emissions and boosting digital infrastructure.

- Reducing the costs of childcare further would help parents, notably mothers, to increase hours in paid employment and training.

The Office for Students (OfS) have issued a new report looking at experimental figures on the strength of local graduate labour markets (I was consulted on this paper).

The method aims to help contextualise graduate outcomes by capturing some of the labour market differences experienced by graduates living in different parts of the UK and to help recognise that we should not have uniform expectations of salary and outcome for the whole UK. It uses two different measures:

- Above-threshold earnings or higher-level study using Longitudinal Education Outcomes (LEO) data. Areas are classified using the proportion of graduates earning over a threshold or studying at a higher level three years after graduation.

- Highly skilled employment using Census 2011 data (to be replaced by Graduate Outcomes survey data in future). Areas are classified based on the proportion of all employed people who are in professional or managerial jobs (SOCs 1 to 3).

The method will be refined over time - it will use newer census data and new Standard Occupational Classifications to get a more up-to-date picture of labour markets.

Just as low paid workers have been worst affected by the restrictions on the sectors they work in, so the reopening of the economy from April onwards should benefit low paid workers the most.

Two reports came in from the Recruitment and Employment Confederation (REC). The first is their Jobs Outlook with Savanta ComRes:

- Business confidence in making hiring and investment decisions rose by 15 percentage points from the previous rolling quarter to net: +28, the highest in almost five years.

- Employer confidence in the UK economy also increased significantly in February to April, rising to net: -10, the highest level since August 2018 and higher than the levels being reported before the onset of the pandemic.

- The single month figure for April 2021 was net: +20, suggesting that the easing of lockdown and vaccination progress is boosting employers' confidence and leading to hiring plans.

- Employers' intentions to hire permanent staff in the short term were highest in the North (net: +31) and London (net: +27) and lowest in the devolved nations (net: +15).

- Employers' intentions to hire temporary agency workers in both the short and medium term remained stable at net: +18 and net: +21 respectively.

- Of those employers who have hired temporary agency workers, contractors or freelancers, 15% said the pandemic had made them more likely to hire those kinds of workers, while only 6% said it made this less likely.

The second is the Report on Jobs with KPMG and IHS Markit:

- Improved market confidence amid a further reopening of the UK economy contributed to the sharpest increase in permanent placements in 23 years in May.

- Temp billings also rose rapidly, expanding at the quickest rate for more than six years.

- The latest upturn in vacancies was the most marked since January 1998. Substantial increases in demand were signalled for both permanent and temporary staff.

- The decline in total candidate availability gathered pace midway through the second quarter. The latest reduction in overall staff supply was the most severe for four years and set in rapidly, with both permanent and short-term candidates falling at substantial rates.

- Lower worker availability was frequently linked to lingering pandemic uncertainty and a subsequent reluctance to seek out new roles, to fewer EU candidates and to furloughed staff.

- Greater demand for workers and a generally low supply of candidates pushed up rates of starting pay again in May. Starting salaries for permanent staff rose to the greatest extent since September 2018, while temp wage inflation hit a near two-year high.

- The North of England saw the steepest increase in permanent staff appointments of all four monitored English regions, though rates of growth were also sharp elsewhere.

- The sharpest rise in temp billings was seen in the North of England, followed by the South of England. Meanwhile, the Midlands recorded a relatively modest rate of growth, while billings were broadly stagnant in London.

- Vacancies continued to rise more sharply in the private than the public sector, with the quickest increase in demand seen for permanent staff in the private sector. The softest growth of demand was seen for permanent workers in the public sector, though the upturn was nonetheless sharp overall.

- Demand for permanent workers rose across all ten monitored job categories during May. The steepest increases in vacancies were seen in IT & Computing and Hotel & Catering. Retail meanwhile saw the softest expansion in demand.

IHS Markit's UK Manufacturing Purchasing Manager's Index for May was also positive:

- The seasonally adjusted IHS Markit/CIPS Purchasing Managers' Index rose to 65.6 in May, up from 60.9 in April, and above July 1994's previous record high of 61.0.

- The PMI has signalled improvement in each of the past 12 months. Underpinning the latest increase were record gains in new business, as domestic and overseas demand continued to revive.

- Companies linked new order growth to rising business confidence, the further re-opening of the UK economy and reduced issues relating to COVID-19.

- While large companies were seeing record gains in new export work, the rate of increase at small firms was comparatively mild.

- The sector is now seeing record backlogs of work, leading to a rapid increase in hiring (as also seen in the ONS data from Adzuna).

- Shortages of raw materials and transport delays are leading to sharply rising prices, with the rate of inflation in the sector the highest it has been for decades.

British Chambers of Commerce have been monitoring small business confidence:

- 63% are emerging from lockdown with either concrete plans or intentions to grow their business over the next 12 months.

- The manufacturing sector (68%) is particularly optimistic, while 58% of the hardest hit business-to-consumer (B2C) firms such as hospitality, catering and retail still anticipate growth.

- 53% said they had already restarted or returned to pre-pandemic levels in April, with a further 27% expecting to reach this milestone by October. By the end of the year, 91% of businesses expect to have fully restarted, with only 1% not expecting to restart for the foreseeable future.

- For many, the biggest barriers to reopening are COVID-related, such as the risk of further lockdowns (cited by 38% of respondents) or social distancing requirements (cited by 37%). Concerns around reduced customer demand (33%), inflation pressure (18%) and recruitment difficulties (14%) are also weighing on UK businesses.

The Resolution Foundation have published a new report on the experiences of the low-paid during the pandemic:

- A rising minimum wage has driven down low pay. The run up to the crisis was a positive one for low paid workers, with a fast-rising minimum wage improving the pay of the lowest earners. This was driven by the introduction of the National Living Wage in 2016. A worker working full time on the minimum wage in 2020 would have been paid roughly £1,700 more than if the minimum wage had continued to increase at its pre-2016 pace. In 2020 the proportion of workers in low pay (defined as earning less than two thirds of median pay) fell to its lowest level in 42 years.

- Low paid workers continue to bear the brunt of the crisis. Low paid workers have been more adversely affected by the COVID-19 crisis than higher paid workers. Low paid workers have been three times as likely as higher paid workers to experience a negative impact on their work: in March 2021, more than one-in-five (21%) workers in the bottom weekly pay quintile had either lost their job or lost hours and pay due to the crisis, or were furloughed, compared to less than one-in-ten (7%) of those in the top earnings quintile.

- Just as low paid workers have been worst affected by the restrictions on the sectors they work in, so the reopening of the economy from April onwards should benefit low paid workers the most. Rates of (full or partial) furloughing in hospitality fell from 58% at the end of March to 48% at the end of April. Employees in retail, hospitality and leisure - the three largest low-paying sectors of the economy - account for more than half (55%) of the 880,000 fall in furloughed workers during April.

- Most workers leaving furlough are returning to their previous job. In March of this year, 44% of previously-furloughed workers were back in work in their previous job, and a further 12% had found new jobs. 34% were still furloughed and 7% were no longer working. Those in the bottom half of the pay distribution were more likely to still be furloughed - likely reflecting the slower opening up of lower-paying sectors such as hospitality and leisure. Previously-furloughed workers in retail have been relatively more likely to find new jobs in other sectors.

- Job quality for low paid workers is unlikely to improve without a tight labour market - and may worsen if unemployment rises. Beyond the immediate reopening period, there are risks facing low paid workers. This includes rising unemployment as the Job Retention Scheme ends, but also a deterioration in (or at the very least no improvement in) job insecurity and abuses of employment rights.

- Problems of insecurity and abuse of employment rights are already unacceptably prevalent. 20% of low paid workers has an insecure job, defined as having a zero hours contract, involuntary working on a temporary contract, or working low hours and wanting more. This compares to 6% of higher paid workers. And 14% of workers in the lowest pay quintile said they did not receive any paid holiday - compared with 6% of the highest paid workers.

22% of employees say they have personally experienced or seen discrimination of some sort in their workplace, with many citing race as the primary pretext.

Henley Business School have carried out research into racial equality in the workplace. Researchers interviewed 500 business leaders and 1,000 employees, as well as carrying out qualitative interviews with 22 business leaders and employees from a broad range of industries. Further research was conducted to gather specific business performance and diversity data points from companies listed on the FTSE 350.

- Factors such as perceived cultural differences (cited by 56% of employees and 52% of business leaders) and a lack of diversity in leadership (33% of employees) are driving racial inequity and systemic racism within UK businesses.

- 22% of employees say they have personally experienced or seen discrimination of some sort in their workplace, with many citing race as the primary pretext (55%).

- Businesses that actively confront inequity and racism with practical measures can expect to see an improvement in their employees' job satisfaction, loyalty, creativity and, ultimately, value, recording an average revenue 58% higher than those which did not.

The CIPD and Accenture have found a surge in the use of digital learning during the pandemic. The report, which surveyed over 1,200 UK organisations, highlights how the learning profession has adapted as a result of COVID-19 and its disruption to the world of work:

- 77% of organisations say they're successfully using learning technology and 69% saying they're innovating in their use of learning technology.

- 51% of learning professionals have assessed the impact of automation on roles and how to redeploy talent (up from 40% in 2020) and 64% have assessed which roles are changing and how to reskill employees (up from 56% in 2020).

- 81% of organisations agree or strongly agree that they understand the skills in their own team and the skills they'll need for tomorrow.

- But 32% of learning professionals have seen their headcount and 31% their budget decrease in the last year.

- While the use of “basic” digital learning, like webinars, has increased, the use of 'sophisticated' digital learning - which can be more accessible, engaging, and effective - has stalled. For example, the proportion of organisations using mobile apps in 2021 (13%) is level with 2020 (12%).

The Learning and Work Institute have published this paper on the experiences of workers in London. It's based on polling conducted by YouGov with Londoners on their perceptions and priorities for work.

- Londoners prioritise adequate salary, a good work/life balance and feeling valued at work in a job.

- Almost half of London workers are currently dissatisfied with their salary and over 40% are dissatisfied with opportunities for progression. Reflecting the impacts of the pandemic on London, more than one in six have become dissatisfied with their pay since the onset of the pandemic and one in ten with opportunities for progression.

- Nearly one in five working in London do not have a secure contract with a minimum set of hours. This rises to 41% among low-income workers, and 44% among part-time workers.

- There was a high prevalence of work-related stress impacting on workers' well-being in the last year. 39% of London workers have felt unwell due to work-related stress during the last 12 months.

- Londoners' outlooks on their future careers appears to be largely driven by age and employment status, with older, low-income and part-time workers less likely to feel positive about future opportunities for progression.

- Views on barriers to better work vary according to ethnicity, gender, age - highlighting inequalities in access to opportunity and individuals' experience of discrimination. Over a quarter of Black, Asian and Minority Ethnic Londoners identified ethnicity as a barrier to better jobs, while 15% of women saw gender as a barrier.

- Low-income and manual workers were more likely to cite lack of access to training opportunities and qualifications as barriers to better work.

- With rates of in-work poverty rising, the cost of living, pay and training were at the top of Londoners' priorities for action on employment by the Mayor of London.

Indeed have issued a new round of data on vacancies in the UK and Ireland:

- UK job postings were 0.8% above the 1 February 2020, pre-pandemic baseline, seasonally adjusted, as of 21 May, 2021. Irish figures were 0.6% below the baseline - nearly there, but not quite.

- Most UK occupations saw job posting gains in the past fortnight. The strongest improvement was in social science, a diverse category which includes psychologists, environmental health officers, librarians, researchers and economists. Sports & cleaning & sanitation saw further gains. Meanwhile, the reopening of indoor hospitality on 17 May helped boost job postings in the hospitality & tourism and food preparation & service categories.

- Job posting growth in Ireland over the past four weeks has been strong in sectors reopening or due to reopen over the coming weeks, including beauty & wellness, hospitality & tourism, food preparation & service and sports.

- Dublin and London both lag their respective national economies in terms of job recovery - a trend seen in capital cities across Europe.

Finally, the Economics Observatory has looked at how the UK labour market has responded to recessions over the last 150 years, from 1870 onwards.

- The industries and regions that grow rapidly during recoveries are not those that lost most jobs during the recession, leading to excess demand in sectors that are on a growth trend and excess supply in those undergoing long-term decline.

- Workers laid off in deep recessions lose job-specific skills (and often the motivation to regain employment), making it harder to match unemployed workers with the new vacancies on offer in the recovery.

- In downturns, firms tend to retain more of their skilled workers than are strictly required so that in the recovery, this excess capacity declines and output grows faster than employment.

It's a fascinating read that shows how labour markets change and adapt.

Was this page useful?

Thank you for your feedback