Charlie Ball provides an update on the latest economy and jobs data, as well as taking a look at two reports covering hybrid working

Data from the Office for National Statistics (ONS) revealed that UK GDP fell by 0.1% in Q2 2022 and by 0.6% in June.

- Services fell by 0.5% in June 2022, and was the main driver of the fall in GDP. A decline in human health activities was the largest contributor as test and trace activity reduced further and vaccinations continued to tail off, following the spring booster campaign.

- Production fell by 0.9% in June 2022, following an increase of 1.3% in May. This was mainly because of a fall of 1.6% in manufacturing following strong growth in May 2022.

- Construction also fell by 1.4% in June 2022, following seven consecutive months of growth.

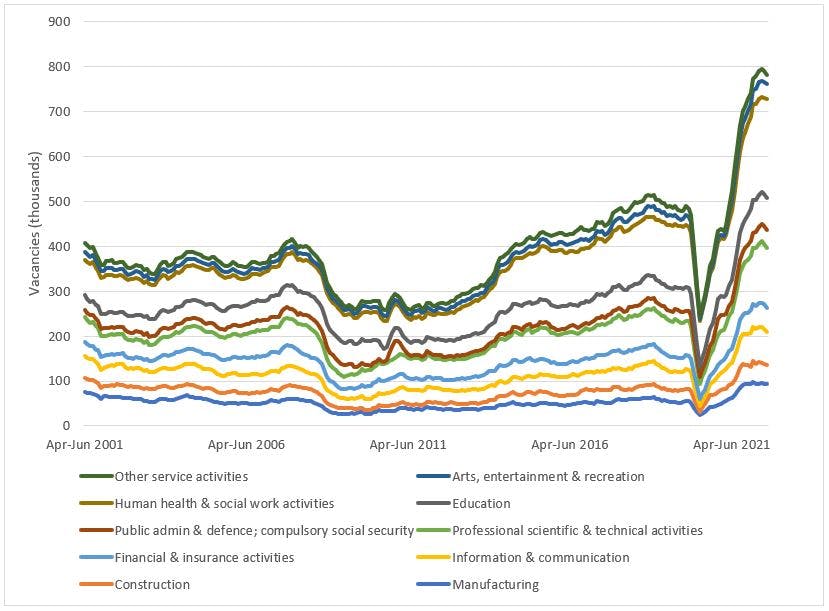

Since vacancies fell to an all-time low in April to June 2020, they have increased by 945,000 in a little over two years.

The UK labour market data for June came out on 18 August:

- The latest Labour Force Survey estimates for April to June 2022 show little change in rates over the quarter. There was a small decrease in the employment rate, a small increase in the unemployment rate while the economic inactivity rate remained unchanged.

- The UK employment rate for people aged 16 to 64 years decreased by 0.1 percentage points on the quarter to 75.5%, and is still below pre-coronavirus pandemic levels. The number of people in employment aged 16 years and over increased on the quarter by 160,000. The number of full-time employees increased and the number of part-time workers decreased during the latest three-month period. The number of self-employed workers fell in the first year of the pandemic and has remained low, although the number has increased slightly during the latest three-month period.

- The most timely estimate of payrolled employees for July 2022 shows a monthly increase, up 73,000 on the revised June 2022 figures, to a record 29.7 million.

- The unemployment rate for April to June 2022 increased by 0.1 percentage points on the quarter to 3.8%. The number of people unemployed for up to 12 months increased during the latest three-month period, with those unemployed for between 6 and 12 months increasing for the first time since February to April 2021. This increase was partially offset by a decrease in those unemployed for over 12 months.

- During the first year of the pandemic, there was a decrease in the employment rate and increases in the economic inactivity and unemployment rates for both men and women. However, the unemployment rates for both men and women have now returned to levels similar to those seen before the pandemic.

- The decrease in the employment rate in the latest three-month period (April to June 2022) was driven by both men and women, while the increase in the unemployment rate was driven by women.

- The economic inactivity rate was unchanged on the quarter at 21.4% in April to June 2022. The increase in economic inactivity since the start of the coronavirus pandemic had been largely driven by those who were students and the long-term sick. In the latest three-month period, there was an increase in the number of people who were economically inactive owing to long-term sickness.

- The number of job vacancies in May to July 2022 was 1.274 million, a decrease of 19,800 from the previous quarter and the first quarterly fall since June to August 2020. Nevertheless, this is still a very large number of vacancies. Since vacancies fell to an all-time low in April to June 2020, they have increased by 945,000 in a little over two years.

- In May to July 2022 vacancies were 478,800 (60.2%) above their January to March 2020 pre-coronavirus level and 309,500 (32.1%) above the level of a year ago.

- In May to July 2022, the ratio of vacancies for every 100 employee jobs fell to 4.2, the first fall since April to June 2020, but still, in historic terms, a very high level.

- Flows estimates show that, since January to March 2022, there has been a movement of people from economic inactivity into unemployment, and from unemployment into employment. Additionally, job-to-job flows have fallen in the latest period, but they remain high and continue to be driven by resignations rather than dismissals - or, in other words, people finding new jobs.

- The total actual weekly hours worked in the UK have been increasing since the relaxation of lockdown measures. Compared with the previous three-month period, total actual weekly hours worked decreased by 0.8 million hours to 1.04 billion hours in April to June 2022. This is still 9.5 million hours below pre-coronavirus pandemic levels (December 2019 to February 2020). However, total actual weekly hours worked by women exceeded pre-coronavirus pandemic levels.

- After falling sharply in the early stages of the coronavirus pandemic, the average actual weekly hours worked have now returned to levels similar to those seen before the coronavirus pandemic, with the average hours worked by part-time workers 0.3 hours above their pre-pandemic levels. Consequently, the shortfall in total hours compared with pre-coronavirus pandemic levels is down to the reduced numbers in employment rather than current workers working less.

The graph below examines UK vacancies by industry (in thousands) since April 2001 for the major graduate recruiting industries:

Scottish labour market data is here:

- The latest estimates for April to June 2022 are little changed over the quarter. The unemployment rate stayed the same, while the employment rate decreased slightly and the economic inactivity rate increased slightly.

- The estimated unemployment rate in Scotland was 3.2%, down 0.5 percentage points since before the pandemic. Scotland's unemployment rate was a joint record low (with previous quarters Feb to Apr 2022, Jan to Mar 2022 and Jan to Mar 2019). Scotland's unemployment rate was below the UK rate of 3.8%.

- The estimated employment rate in Scotland was 75.4%, up 0.1 percentage points since pre-pandemic but down 0.1 percentage points over the quarter. Scotland's employment rate was slightly below the UK rate of 75.5%.

- Early seasonally adjusted estimates for July 2022 from HMRC Pay As You Earn Real Time Information indicate that there were 2.43 million payrolled employees in Scotland, an increase of 1.8% (43,000) compared with February 2020. This compares with the UK where the number of payrolled employees has increased by 2.2% over the same period.

- Early seasonally adjusted estimates for July 2022 from PAYE indicate that median monthly pay for payrolled employees in Scotland was £2,118, an increase of 12.8% compared with February 2020 (pre-pandemic). This is lower than the growth in median monthly pay for the UK over the same period (13.4%).

Next, data for Wales is here:

- The employment rate in Wales was 72.7%. This is down 1.4 percentage points on the quarter and down 1.4 percentage points on the year. This is the largest annual decrease since November to January 2021 and the largest quarterly decrease since August to October 2020.

- The UK employment rate was 75.5%. This is down slightly on the quarter and up 0.5 percentage points on the year.

- The unemployment rate in Wales was 3.8%. This is up 0.8 percentage points on the quarter and down 0.3 percentage points on the year.

- Early estimates for July 2022 indicate that the number of paid employees in Wales has increased by 1,200 (0.1%) over the month to 1.30 million. This is above the pre-pandemic estimates for February 2020, and an increase of 72,300 since the lowest point of the pandemic in November 2020.

- In April to June 2022, the employment rate in Wales decreased for males and for females compared to the previous year. Compared the previous quarter, the rate for males is unchanged and the rate decreased for females.

- In July 2022, the information and communication sector had the largest increase in the number of paid employees compared with the start of the pandemic. The largest decrease over the same period was in the energy production & supply sector.

- The average number of hours worked in the UK remained consistent with pre-pandemic levels in the three months to June 2022, however the total actual weekly hours worked remained below pre-pandemic levels.

- There were 316,000 people employed in the public sector in Wales during 2022 Q1, up by 6,000 (1.9%) from 2021 Q1.

- The number of workforce jobs in Wales rose by 46,800 (3.2%) between March 2021 and March 2022 to 1.49 million.

- The number of self-employment jobs in Wales increased by 45,300 (32.3%) between March 1999 and March 2022 to 185,500 (12.4% of the workforce).

Northern Irish data is here:

- The latest NI seasonally adjusted unemployment rate (the proportion of economically active people aged 16 and over who were unemployed) for the period April to June 2022 was estimated from the Labour Force Survey at 2.7%. This was an increase of 0.1 percentage points over the quarter and a decrease of 1.6 percentage points over the year.

- The employment rate decreased by 0.9 percentage points over the quarter and increased by one percentage point over the year to 69.7%. The total number of weekly hours worked in NI (27.8 million) decreased by 0.7% over the quarter and increased by 4.9% over the year.

- The number of employees receiving pay through HMRC PAYE in NI in July 2022 was 779,300, a 0.4% increase over the month and 2.6% over the year. This is the highest on record and the 11th consecutive monthly increase.

- Earnings from the HMRC PAYE indicated that NI employees had a median monthly pay of £1,963 in July 2022, an increase of £2 (0.1%) over the month and an increase of £89 (4.7%) over the year.

- In July 2022, the seasonally adjusted number of people on the claimant count was 35,700 (3.8% of the workforce), which is a decrease of 0.5% from the previous month's revised figure. The July claimant count remains higher than the pre-pandemic count in March 2020 (by 20%).

- NISRA, acting on behalf of the Department for the Economy, received confirmation that 50 redundancies occurred in July 2022, taking the annual total to 1,160. Over the year August 2021 to July 2022, 1,260 redundancies were proposed.

- The latest 12 month totals of both proposed and confirmed redundancies were around 80% lower than the previous year and the lowest in the time series (since 2000).

We also have data from the Isle of Man:

- The latest labour market report, compiled and published by the Statistics Isle of Man team at the Cabinet Office, shows the number of people registered unemployed was 302 for July 2022.

- The figure increased by 17 persons from the previous month (June 2022), and has decreased by 143 persons compared to the same month last year (July 2021).

- The unemployment rate for July 2022 is 0.7%, remaining the same as the previous month.

And data from the UK's regions is here:

- For the three months ending June 2022, the highest employment rate estimate in the UK was in the East of England (78.4%) and the lowest was in Northern Ireland (69.7%).

- Most regions of the UK saw an increase in the employment rate compared with the same period last year, with the largest increase seen in Yorkshire and The Humber, which was up by 1.6 percentage points. Wales was the only region seeing a decrease, down by 1.4 percentage points.

- For the three months ending June 2022, the highest unemployment rate estimate in the UK was in the North East (5.1%) and the lowest was in the East Midlands (2.4%), a record low rate for the region. Scotland had an unemployment rate of 3.2%, which is a joint record low for the region.

- All regions in the UK saw a decrease in the unemployment rate compared with the same period last year. The East Midlands saw the largest decrease, of 1.9 percentage points, while the smallest decrease was in Wales, down by 0.3 percentage points.

- For the three months ending June 2022, the highest economic inactivity rate estimate in the UK was in Northern Ireland (28.3%) and the lowest was in the East of England (18.9%).

- Compared with the same period last year, the largest change in the economic inactivity rate was in Wales, with an increase of 1.7 percentage points, while the largest decrease was in Yorkshire and The Humber, which was down by 1.3 percentage points.

- Between June and July 2022, the number of payrolled employees in the UK continued to increase in all regions, with the largest percentage increases in London and Northern Ireland, and the smallest in the East Midlands and Wales.

The median starting salary for graduates in 2021 was £30,500 while the median starting salary for school and college leavers was £19,489.

The latest rapid indicators of economic and social change are now available from the ONS

- The total number of online job adverts on 12 August 2022 was 6% lower than the equivalent week of 2021, and was 120% of its February 2020 average level.

- In the latest week, total online job adverts were 6% lower than the level in the equivalent day of 2021. This is broadly unchanged from a month ago, when total online job adverts were 5% lower than the level seen in the equivalent day of 2021.

- In the latest week, 14 of the 28 job categories recorded lower online job adverts than the equivalent day of 2021.

- While growth over the 12 UK countries and regions varied, the majority were down from last week with London displaying the largest fall at negative 2%. The regions with the highest number of online job adverts relative to their February 2020 average were Northern Ireland and the North East at 165% and 147%, respectively.

- Scotland and Northern Ireland were the only locations that recorded a higher number of online job adverts compared with the equivalent day of 2021. In Scotland, this figure was 19% higher than one year ago, and in Northern Ireland it was up by 3%.

The ONS have also released results from their fortnightly business survey:

- Of businesses with ten or more employees, 23% reported that their employees' hourly wages had increased in June 2022 compared with May 2022. For businesses of all sizes, this percentage was 12%.

- Approximately 5% of businesses with 250 or more employees offered a one-off cost of living payment to their employees in the last three months; this compares with 1% for businesses with fewer than 250 employees offering a payment.

- Businesses continued to report input price inflation as their main concern for August 2022 at 27%, followed by energy prices at 20%. These have remained the top two main concerns reported by businesses since the question was first introduced into BICS in late February 2022.

The Institute of Student Employers (ISE) have released their latest poll results:

- Average pay growth for graduates is 7% this year with some employers increasing salaries by 20%. This is the sharpest rise in 20 years. On average, graduate starting salaries have risen 2% per year since 2002.

- This year the average pay growth for apprentices is 11%. Some employers have said that they are increasing salaries for apprenticeships by as much as 50%.

- The median starting salary for graduates in 2021 was £30,500 while the median starting salary for school and college leavers was £19,489.

- Young people entering the jobs market this year will also find more financial incentives available such as sign-on bonuses, interest free or low interest loans and salary advance schemes as well as support for transport, accommodation and relocation.

- The ISE poll also found a range of additional incentives being offered including discounts on own branded products, healthcare, maintenance grants, financial and wellbeing advice, charterships, and hardship funds for those with additional financial needs.

The Recruitment & Employment Confederation (REC) have released their latest Labour Market Tracker:

- In the week of 25 to 31 July, the number of active job adverts across the UK hit 1.85 million, active job postings have been slowly but steadily rising since mid-June.

- The number of new job adverts being posted each week has remained relatively stable during late June and July, at between 180,000 and 200,000 per week. In the last week of July there were 182,000 new postings - coming in at 22% below this year's highest figure of 234,000, recorded in the beginning of March.

- The rising number of active postings overall likely reflects job adverts being left open for longer, with employers across the country struggling to attract candidates for their vacancies.

- This data is slightly at odds with new ONS data reporting a slight fall in vacancies, but bear in mind REC deal largely with agencies so ONS could be reflecting falls in recruitment through other channels.

The CIPD have produced their quarterly Labour Market Outlook. As always, this is a very good report produced by particularly good and knowledgeable researchers and is well worth a read:

- The net employment balance - which measures the difference between employers expecting to increase staff levels and those expecting to decrease staff levels in the next three months - remained high at +34. This continues to exceed pre-pandemic levels, pointing to strong employment intentions. 41% of employers are currently looking to hire. Employment intentions are particularly high in information and communication (+53), construction (+48), business services (+47), and admin and support services (+47). Many of these are graduate or college leaver positions.

- 47% of employers have hard-to-fill vacancies. These are most common in education (56%), transport and storage (55%), and the voluntary sector (53%). Even the sector with the lowest level of HTF vacancies, wholesale, retail and real estate runs at 31%; all other industries have at least 44% of employers experiencing recruitment difficulties.

- The top response planned by employers to tackle recruitment and retention difficulties is to upskill existing staff (41%), followed by advertising more job as being flexible (35%). Raising wages comes in third at 29%.

- The proportion of employers planning on making redundancies is below pre-pandemic levels at 13%. Employers' focus on retention and training demonstrates their desire to get more from their existing employers in the face of recruitment challenges.

Reed's July Market Review is here:

- 217,707 adverts were posted on Reed.co.uk in July, down 5% from June.

- 1.5 million applications were made, down slightly by 2% month on month.

- Sectors with the largest drop in vacancies since last month were IT (-10%), Education (-9%), Financial Services (-8%), Marketing & Media (-7%) and Sales (-6%)

- Job vacancies in Safety & Security were up by 7% and 5% in Legal

- Engineering applications increased by 6% compared to June, and legal applications were up by 3%.

- Reed are also reporting that a third of employees have considered or applied for a new job, while 65% now feel a salary increase is their main priority when looking for a new role. It has increased in importance for 34% of workers. In terms of future plans, more than a fifth (22%) plan to begin job hunting, while over half are actively considering looking for a new job.

More than a third of people use the office to establish a proper life/work separation.

Advanced Workplace Associates have been tracking hybrid work across the world and have produced their Hybrid Working Index:

- AWA consulted 79 offices involving 77,000 people across 13 countries in Q2.

- On average 26% of the population are attending the office each day with a peak of 31% in the office on a Wednesday.

- Only 40% of the desks in office are being used at peak time on a Wednesday, with an average run rate of 31% leaving over two thirds of the desks empty on average across the week.

- On average each worker, is attending the office 1.3 days a week, which is similar to the intentions expressed through our surveys during the pandemic.

Meanwhile, real estate consultancy JLL have produced a Hybrid Work Decoded report, surveying employees across 15 countries:

- People are now spending 2.8 days a week in the office but find most of their work - focused work - is easier to do from home due to noisy and distracting office environments.

- France has 3.5 WFO days compared to 2.6 in the UK and 2.3 in Germany.

- Tuesday is the most popular day to work in the office, with Friday the least.

- Working hours in the office are only slightly higher than those from home.

- The key drivers on returning to the office are social interaction, collaboration, and technology support while work-life balance and wellbeing are homeworking strengths.

- Half of all virtual collaboration during the week is happening in the office, and half of the office virtual collaboration is done at the desk.

- More than a third of people use the office to establish a proper life/work separation.

The City of London Corporation have produced a report from an ongoing government-commissioned taskforce examining socio-economic diversity at senior levels across UK financial and professional services:

- The survey collected data from 9,362 employees from 49 organisations between November 2021 and March 2022 for the Socio-Economic Diversity Taskforce.

- 64% of senior leaders are from professional backgrounds, almost double the UK working population (37%) and significantly higher than the financial and professional services workforce at all levels of seniority (49%).

- 20% of sector employees and 26% of senior leaders attended independent or fee-paying schools. 7.5% of UK workers as a whole attended independent or fee-paying schools.

- Working class respondents are more likely to feel that they do not have the same chances of success in the workplace as their colleagues from professional backgrounds. They are more likely to feel like an 'outsider' and are less satisfied with their pace of career progression.

- Only just over a third of working class employees have benefited from a senior sponsor compared with almost half from professional backgrounds.

- 1% of senior leaders surveyed are ethnic minority females from a working class background. 45% are white men from professional backgrounds.

And finally, PWC will no longer require a 2:1 from applicants.

Was this page useful?

Thank you for your feedback