Charlie Ball, head of labour market intelligence at Jisc, takes a look at the latest UK data and finds a graduate jobs market that is doing better than the recession-hit wider economy

UK gross domestic product (GDP) is estimated to have fallen by an unrevised 0.3% in Quarter 4 (October to December) 2023, following an unrevised fall of 0.1% in the previous quarter, according to the Office for National Statistics (ONS).

- The economy decreased for two consecutive quarters, while GDP for 2023 as a whole is estimated to have increased by an unrevised 0.1% compared with 2022.

- In output terms in Quarter 4 2023 there were falls in all three main sectors with declines of 0.1% in services, 1.1% in production, and 0.9% in construction output.

- This means that the UK was in recession in the second half of 2023.

- However, as the data on the labour market shows very clearly, the jobs market for graduates is not in the condition you'd expect in a recession and is outperforming the economy.

Payrolled employees in the UK rose by 15,000 between December 2023 and January 2024, and rose by 386,000 (1.3%) between January 2023 and January 2024. This rise is despite the UK being in recession.

The early estimate of payrolled employees for February 2024 increased by 20,000 (0.1%) on the month and increased by 368,000 (1.2%) on the year to 30.4 million.

The total workforce jobs estimate (which differs from the payrolled data as it includes people not on PAYE, such as the self-employed) rose in December 2023 by 125,000 on the quarter to 36.9 million, with increases in both employee jobs and self-employment jobs.

The estimated number of vacancies in December 2023 to February 2024 was 908,000, a decrease of 43,000 from September to November 2023. The industry showing the largest fall in vacancy numbers was human health and social work activities, which was down by 13,000 from the previous quarter. This is a sector currently in very severe labour shortage, so this is a more complicated situation than 'there is less demand for employees', as we know many employers have stopped advertising vacancies they'd like to fill because of lack of candidates.

Total estimated vacancies in December 2023 to February 2024 were down by 224,000 from the level of a year previously, although they remained 107,000 above their pre- COVID-19 January to March 2020 levels.

The number of unemployed people per vacancy in November 2023 to January 2024 was 1.5, up from 1.4 the previous quarter (August to October 2023), as the number of vacancies continue to fall. 1.5 is still historically quite low though, and as we will see, most vacancies are at degree level, whilst most of the unemployed have lower qualifications.

Firms are hoarding labour as they perceive the jobs market to remain difficult for recruiters - although a few think it will get easier later in the year.

Jobs with most vacancies are predominantly graduate level

The number of online job adverts on 22 March 2024 decreased by 3% when compared with the previous week. For the first time in 2024, all 12 of the UK countries and English regions decreased, with the largest week-on-week fall seen in the South East, at 5%.

Calculated as a four-week rolling average, the number of potential redundancies in the week to 17 March 2024 was 21% above the level in the equivalent week of 2023, while the number of employers proposing redundancies was 27% above the level in the equivalent week of 2023. These are from a low level this time last year, but it does show a gradual worsening of the UK labour market.

The ONS also released data earlier this month on job demand by Standard Occupational Classification from 2017 onwards - which also includes regional breakdowns. This is a very interesting dataset with a lot of detail in it, but two things stand out.

First is that seven out of the top ten jobs with the most vacancies, including the top occupation, computer programmers, are graduate level roles:

- Computer programming

- Sales accounts managers

- IT technicians

- Business sales executives

- Nurses

- Business project managers

- IT project managers.

The other three were care workers; bookkeepers and payroll managers; and nursing auxiliaries, which are all jobs that FE graduates enter in numbers and to which many college qualifications point.

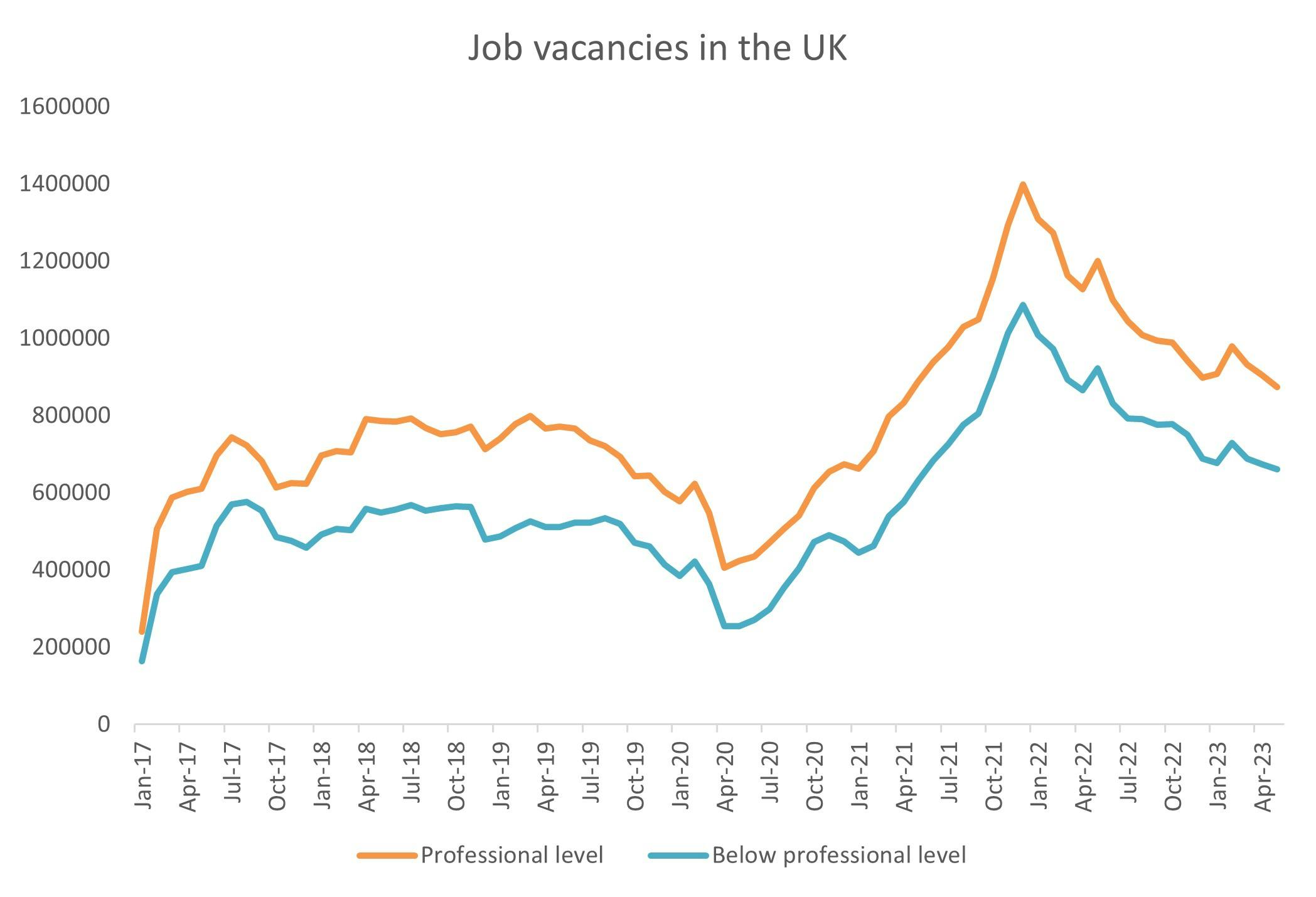

The second is that most vacancies in the UK are at professional level, and have been for years, as seen from the graph below.

Hybrid working levels have remained steady

The Bank of England have issued their quarterly Agents Summary for Q1 of 2024. They say that most firms are looking at maintaining employment and few are reporting redundancy. Firms are hoarding labour as they perceive the jobs market to remain difficult for recruiters - although a few think it will get easier later in the year. Recruitment difficulties continue to ease, although some local labour markets and sectors such as engineering, software and manufacturing - all areas with long term labour shortages, and all important graduate recruiting industries - continue to struggle.

The Recruitment & Employment Confederation's (REC) Labour Market Tracker also adds to the picture, reporting a 'soft landing' for the jobs market as it outperforms the wider economy but subsides a little as economic conditions continue to get trickier.

REC's figures, looking at agency roles, show the number of active postings in February 2024 was 1,873,386, substantially lower than a year ago (2.5 million) but still well ahead of the equivalent figure for February 2020 (1.57 million).

There were 810,651 new job postings in February 2024 – a 5.5% fall from the month before, but still substantial.

Adzuna, meanwhile, detects signs of the recent slide in vacancies actually slowing. Their most recent Job Market Report from 25 March suggests a flat market in February, with 866,242 advertised job vacancies, falling just -0.1% compared to January.

Adzuna do have measures that we don't see elsewhere, and their time-to-fill metric is very interesting. Companies are still taking long to make decisions about new team members, perhaps in response to the reduction in hiring budgets. Advertised vacancies were live on average for 36.6 days before being filled in November 2023 (the latest data), the same as October 2023 and the longest time-to-fill since January 2023.

Elsewhere, Indeed have looked at data on wages and job ads and concluded that the decline in job postings overall appears to be largely driven by outsized declines in middle-wage jobs. Job postings for mid-wage jobs are 12% below their pre-pandemic baseline. High-wage job postings are down just 5% from the same period, while low-wage postings are 1% above the baseline.

Fields in this middle-wage tier include human resources, real estate, construction, insurance and IT support, which have been hit by slowdowns in the recruitment, financial, property and tech sectors. While certain high-wage categories like software development and banking & finance have also been affected by these trends, less cyclical occupations in the high-wage category including physicians & surgeons, medical technicians and education & instruction have held up better.

Indeed have also been tracking the incidence of hybrid working in job ads and concluded that despite some calls for workers to return to the office, UK (and European hybrid working levels in general) have remained steady, with only Italy seeing significant falls.

And finally, if you want a very quick summary of where we are now in the UK graduate labour market, I have written one for the Institute of Student Employers (ISE).

Was this page useful?

Thank you for your feedback