Charlie Ball looks at the latest reports and data on the UK's graduate labour market, including an examination of job creation dynamics and an analysis of how businesses are using AI

The 2021/22 Graduate Outcomes release is available from HESA (part of Jisc), looking at outcomes of graduates from UK higher education institutions 15 months after graduation.

Meanwhile, the economy decreased for two consecutive quarters, while GDP for 2023 as a whole is estimated to have increased by an unrevised 0.1% compared with 2022. In output terms in Quarter 4 2023 there were falls in all three main sectors with declines of 0.1% in services, 1.1% in production, and 0.9% in construction output. This means that the UK was in recession in the second half of 2023.

However, as the data on the labour market shows very clearly, the jobs market for graduates is not in the condition you'd expect in a recession and is outperforming the economy.

Payrolled employees in the UK decreased by 36,000 (0.1%) between March and April 2024, but rose by 201,000 (0.7%) between April 2023 and April 2024, data from the Office for National Statistics (ONS) shows

- The early estimate of payrolled employees for May 2024 decreased by 3,000 (0.0%) on the month but increased by 167,000 (0.6%) on the year, to 30.3 million.

- The total workforce jobs estimate (which differs from the payrolled data as it includes people not on PAYE, such as the self-employed) rose in March by 431,000 on the year to 37.2 million, with increases in both employee jobs and self-employment jobs. Human health and social work saw the largest increase, up by 228,000 (4.8%), in contrast to the previous quarter when it was the largest faller.

- In March to May 2024, the estimated number of vacancies in the UK decreased by 12,000 on the quarter to 904,000 - this figure is gently increasing and decreasing on a month-by-month basis at the moment.

- The total estimated number of vacancies remains 108,000 (13.6%) above its January to March 2020 pre-coronavirus pandemic level. The two industry sectors that have increased the most from their January to March 2020 levels are human health and social work activities and professional, scientific and technical activities, which were up by an estimated 26,000 and 22,000 vacancies, respectively. Both sectors are predominantly employers of graduates. Four industry sectors decreased below pre-pandemic levels with a combined reduction of 28,000 vacancies, with wholesale and retail trade; repair of motor vehicles and motorcycles decreasing the most, down by an estimated 21,000 vacancies.

- In February to April 2024, the number of unemployed people per vacancy was 1.7, up from 1.5 the previous quarter (November 2023 to January 2024) because of falling vacancy numbers alongside rising unemployment.

Monthly real gross domestic product (GDP) is estimated to have grown by 0.4% in May 2024 after showing no growth in April 2024.

Real gross domestic product is estimated to have grown by 0.9% in the three months to May 2024 compared with the three months to February 2024, driven by a growth of 1.1% in services output.

- Services output grew by 0.3% in May 2024, following growth of 0.3% in April 2024, and was the largest contributor to monthly GDP growth in May 2024.

- Production output grew by 0.2% in May 2024 following an unrevised fall of 0.9% in April 2024, and showed no growth in the three months to May 2024.

- Construction output grew by 1.9% in May 2024, following a fall of 1.1% in April.

The total number of online job adverts on 5 July 2024 increased by 1% when compared with the previous week but was 19% below the level in the equivalent period of 2023. Vacancies had been falling through 2024 but seem to, at least for now, bottomed out in late April and now seem stable.

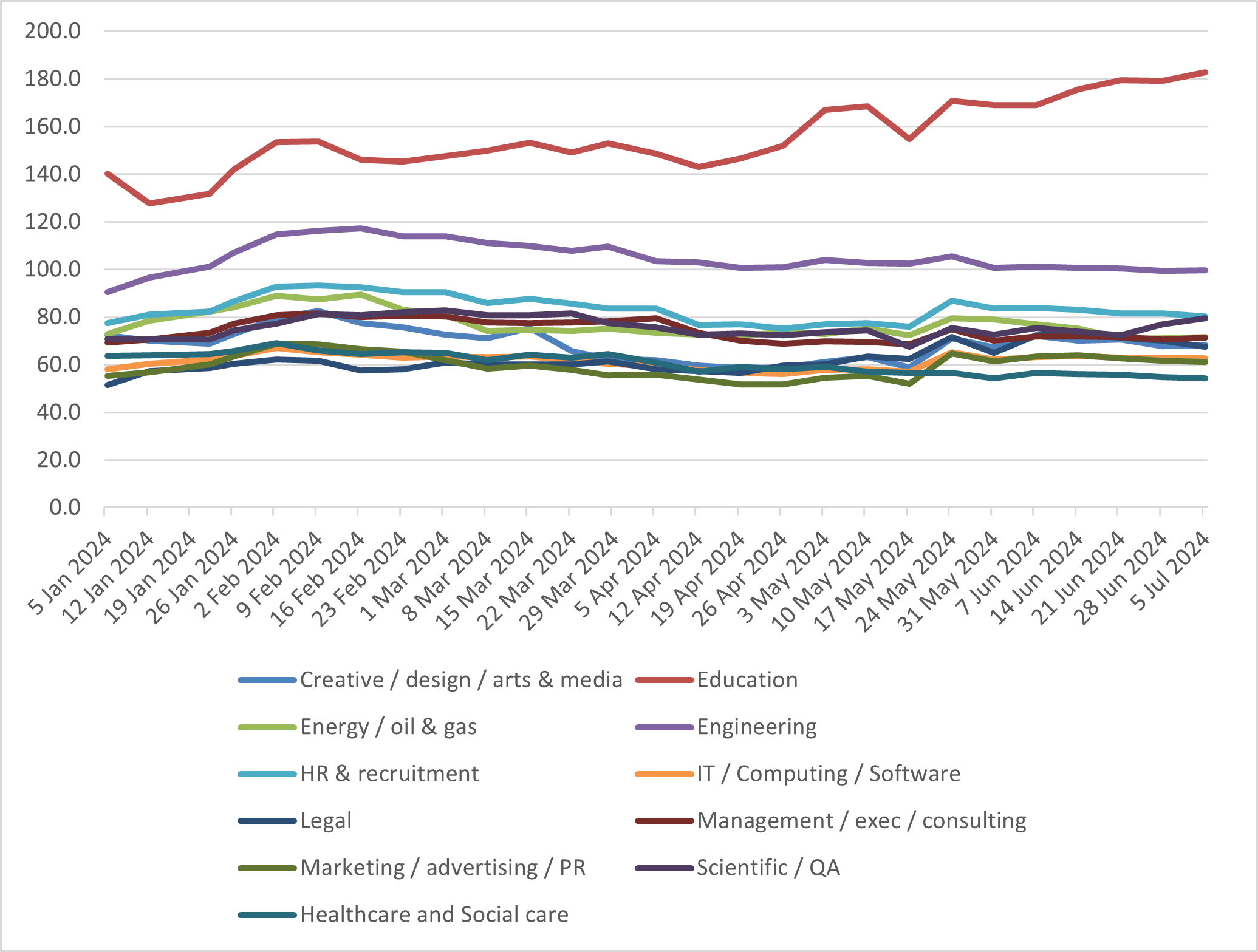

This rather complex chart looks at some key graduate employment industries since the start of the year - 100 is the level of jobs at February 2020, the last date before COVID lockdowns. Most graduate recruiting industries have stabilised at a level below pre-COVID figures, engineering is around pre-COVID levels, but education, facing serious shortages, is now well above vacancy levels pre-COVID and is increasing quite quickly.

How business are using AI

13% of businesses reported that they are currently using some form of artificial intelligence (AI) technology in late June 2024, broadly stable with March 2024; for businesses with 250 or more employees, this percentage was higher at 25%, a rise of two percentage points over the same period.

You probably don't need to be told it's the IT industry who are most likely to be using AI, but even then only 42% of UK IT businesses were using it.

Data processing using machine learning was the most common use of AI, with LLMs closing in. London businesses were the most likely to be using AI, but for visual image creation, image processing using machine learning and robotics, it is businesses in Northern Ireland who are most likely to use these technologies - Belfast is a major UK IT hub.

40% of businesses using AI are using it for process improvement. 14.5% are using it to personalise products and services, and 12.5% are developing new products.

Elsewhere, the ONS also released data at the end of June on job demand by Standard Occupational Classification from 2017 onwards - which also includes regional breakdowns. This is a very interesting dataset with a lot of detail in it, but two things stand out.

First is that five out of the top ten jobs with the most vacancies, including the top occupation, computer programmers, are graduate level roles (Computer programming; sales accounts managers; IT technicians; business sales executives; nurses). The others were care workers; bookkeepers and payroll managers, metalworking production and maintenance, teaching assistants and nursing auxiliaries, which are jobs that FE graduates enter in numbers (and which in many cases are initial points of entry to the labour market for graduates) and to which many college qualifications point.

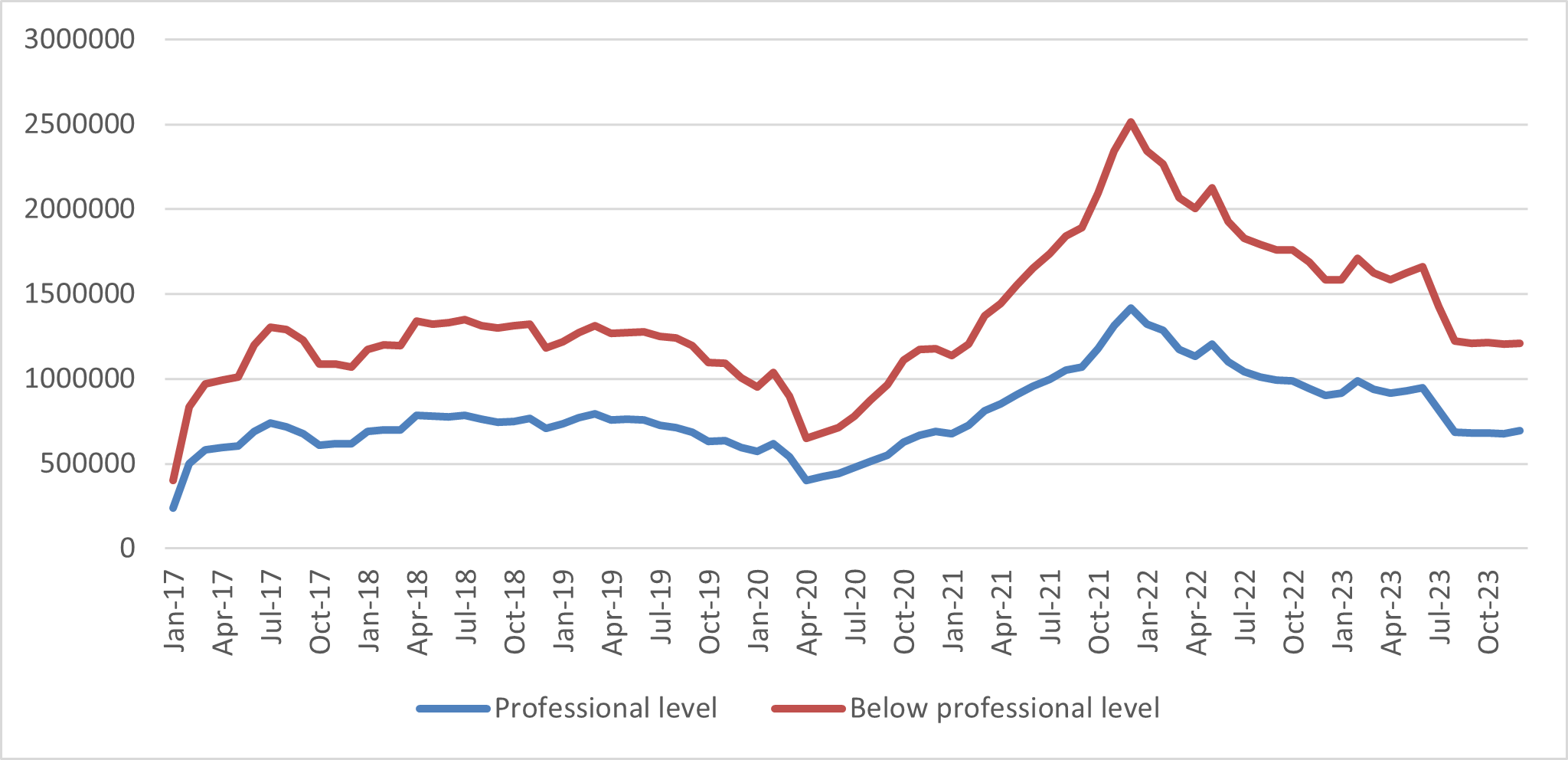

The second is that most vacancies in the UK are at professional level, and have been for years, as seen from the graph below.

This is a very interesting release and I hope to have more to say about the regional aspects of it soon.

Analysing job creation dynamics

The ONS have also released some very interesting new examinations of job creation dynamics:

- During a business or organisation's lifecycle, they will create jobs as they open and grow, and will remove jobs when they shrink and close. As jobs are removed by firms that shrink or close, displaced workers flow to opening or expanding enterprises.

- A steady rate of creation and destruction is necessary for an economy to grow in the long term, because it allows new ideas and activities to flourish. This process is tied to the idea of 'creative destruction', proposed by economist Joseph Schumpeter.

- Firms can add jobs to local economies by either creating new employment sites or by increasing the number of people they employ at their existing employment sites. Firms can also destroy jobs by reducing the number of people they employ at existing employment sites or by closing employment sites entirely.

- Between 2004 and 2022, the rate at which jobs were being created and destroyed fell in around 87% of international territorial level 3 (ITL3) regions.

- The fall in job creation rates ranged from negative 7% to positive 3% and the fall in job destruction rates ranged from negative 8% to positive 2% in ITL3 subregions.

- In 2022, a net addition of around 411,000 jobs occurs because of a total of 4.4 million jobs being created by firms and a further 4.0 million jobs being destroyed at the same time. This reflects the large level of labour reallocation or churn that exists beneath overall changes in employment.

- Between 2004 and 2007, on average, for every one job created by at an existing employment site, 1.3 was created by a new employment site being created within a given area. In the 2020 to 2022 period, this ratio had fallen to just under one.

- This means that local economies are becoming more reliant on expansion from within already existing employment sites to drive their job growth.

- Across all industries, most job creation has been caused by employment growth from within existing continuing employment sites. Job creation from this channel has remained largely consistent over time.

- In contrast, the contribution to job creation of existing firms opening additional new employment sites has declined across a number of different industries. Generally, we see the largest fall from this channel in service sectors of the economy. The effect is still seen in production, manufacturing, and construction industries, but to a smaller extent.

The Recruitment & Employment Confederation' (REC) latest Report on Jobs came out last week:

- Permanent staff appointments continued to fall in June, according to the latest survey data. Moreover, the rate of contraction accelerated to the steepest for three months amid reports of a lack of demand for staff. There was also evidence that the general election had caused some uncertainty and acted as a brake on recruitment activity.

- Firms were instead keener to offer temporary contracts, with the latest data showing a rise in temp billings (albeit marginal) for the first time since last October.

- The availability of candidates to fill roles continued to increase in June, extending the current period of growth to 16 months. Permanent and temporary staff availability both rose sharply, though in each case to lesser degrees than in May. Recruitment consultants reported that the latest increase in the supply of staff reflected a combination of redundancies, slow decision-making amongst clients and a lower number of job openings.

British Chambers of Commerce have released their Quarterly Economic Survey for Q2, a vital look at business priorities and concerns.

- The percentage of respondents reporting increased domestic sales rose to 38%, compared with 36% in Q1. 43% of firms said sales had remained constant and 20% reported a decrease.

- There were some sectoral differences - 37% of manufacturers and 40% of business-to-business service companies (such as legal and finance) reporting a boost in sales. By contrast, only 33% business to consumer firms (such as hospitality and retail) saw an increase.

- Business confidence has increased, with 58% of firms expecting an increase in turnover in the next twelve months.

- Despite a boost in conditions and confidence most firms (75%) are still not increasing investment, with wide sectoral variations. 42% of transport and logistics firms say they have increased investment levels, while the figure for retail companies was just 19%.

- Labour costs continue to be cited as the main cost pressure across all businesses. 67% of responding firms say they are under pressure to raise prices because of this (68% in Q1). Some sectors are feeling this pressure more than others, with 77% of hospitality firms and 76% of construction or engineering firms citing it as a key driver. This may constrain new hiring.

Was this page useful?

Thank you for your feedback